Vietnam’s stock market has gained a positive momentum. On the real economy side, however, there are still headwinds: Vietnamese consumer confidence has experienced a momentary bump, and at the same time, exports have recorded weak numbers.

The decisions already implemented by the government and the central bank play an important role when assessing the stock market’s performance in the next 12 months. Vietnam’s interest rates have fallen significantly and will continue to fall. During the last 8 months, the yield curve of Vietnam’s 10-year government bond has fallen from 5% to 2.5%, which reflects the already substantially eased interest rate situation in Vietnam’s domestic market. The overnight interbank rate has dropped to 0.17%, indicating very strong liquidity in the financial system. The 12-month term deposits made at the end of 2022 will mature at the end of autumn 2023, and the cash will be reallocated to other investments, for example, stocks.

We believe that Vietnam’s economic growth will clearly accelerate during the autumn thanks to the measures already taken. Thanks to the same factors, it is reasonable to assume that 2024 will again be a year of strong growth for Vietnam’s economy. We believe that local cash will return to equities and that Vietnam’s stock market index will continue to recover during this fall. The bullish sentiment can be assumed to continue into 2024 as well.

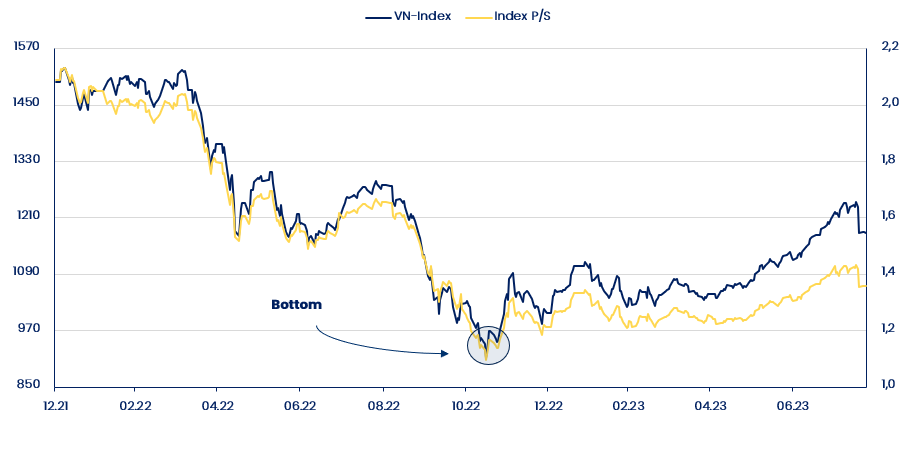

The slowdown of Vietnam’s economy was strongly linked to the country’s interest rates and liquidity conditions. We believe that when the situation normalizes, the stock market will again be able to trade at levels of 2.0 and above, when valuating the market’s pricing with the P/S ratio (Price/Sales). The latest figure is 1.35. That includes the rolling sales figure, i.e. the growth in revenue in the slow quarters at the beginning of the year. With the estimated revenue growth for 2024, the P/S ratio falls below 1.2, which makes the stock market look very attractively priced right now.

Important information regarding the text and the Fund

The attached publication is marketing material and should not be regarded as a recommendation to subscribe or redeem units of the PYN Elite Fund. Before subscribing please familiarize yourself with the Key Information Document, the Prospectus and the Rules of the Fund. The material presented in this text is based on PYN Fund Management’s view of markets and investment opportunities. PYN Elite Fund (non-UCITS) invests its assets in a highly allocated manner in frontier markets and in a small number of companies. This investment approach involves a larger risk of volatility compared to ordinary broadly diversified equity investments. The value of an investment may decline substantially in unfavorable market conditions or due to an individual unsuccessful investment. It is entirely possible that the estimates of economic development or a company’s business performance presented in this presentation will not be realized as presented and they involve material uncertainties.