VN Index -31.9% YTD

VND Forex -8.1% YTD

PYN Elite -37.3% YTD

(21.10.2022)

What is going on in the markets?

Vietnam’s stock market has been globally one of the worst performers this year. In recent months, the value of Vietnam’s currency, the dong, has also weakened rapidly. Both of these factors have led to poor returns for PYN Elite. There has been panic selling which has hit particularly companies whose growth is driven by domestic demand, and which are weighted heavily in the PYN Elite portfolio.

On the other hand, the Prime Minister of Vietnam estimated last week that the country’s economy will grow strongly during 2022 and that GDP growth will exceed 8%. Inflation in Vietnam has remained very moderate, below 4%, because the price of energy is regulated, and Vietnam is largely self-sufficient in terms of both energy and food

The solvency of Vietnam’s listed companies is at a very good level: the debt-to-equity (D/E) ratio of the 50 largest listed companies stands at 0.21, and in early autumn, the credit rating company Moody’s upgraded Vietnam’s Sovereign Bond ratings for the third time in the last 10 years. The earnings growth outlook for Vietnamese equities for 2022 is over 20 % y/y. Solid growth is also expected for 2023, although interest rate hikes and weaker export growth will certainly slow down general economic growth.

As a portfolio manager, I am confused and surprised by such a weak performance of the stock market. The Vietnamese equities were not overvalued at the start of 2022. Our Fund was aware of the extremely high valuations of US growth companies and the potential for greater market turbulence. We took a cautious approach to the economic outlook of the USA and Europe, but we did not take into account how external uncertainties, combined with the disciplinary measures by financial regulators in Vietnam, could create such a challenging situation for the stock market, especially when the companies’ earnings growth has been so adequate.

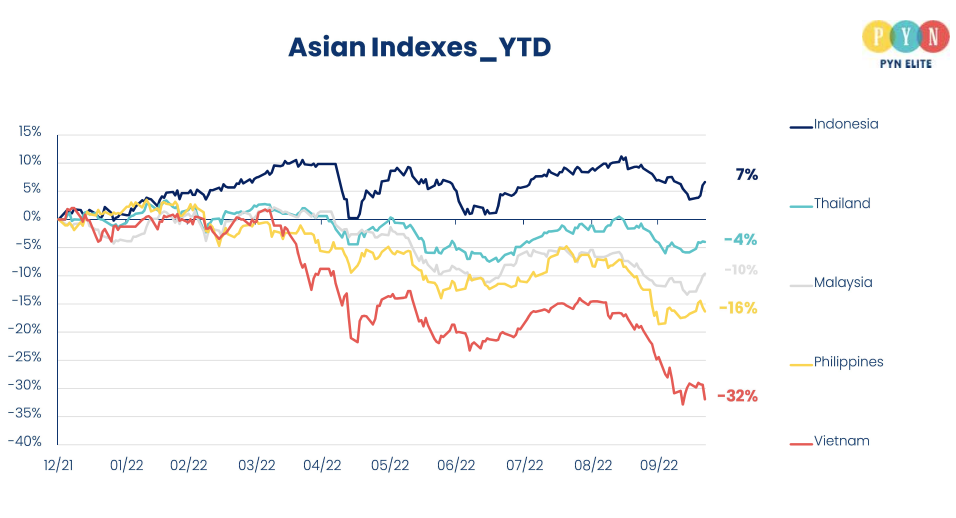

In a comparison of Vietnam’s market performance to other Southeast Asian markets, it can be concluded that up to two-thirds of the weak performance of the Vietnamese stock market is due to internal reasons. Government’s disciplinary actions may in the long term raise investors’ confidence, but in the short term, they have caused complete chaos in the market.

What has the Government done?

The Vietnamese regulators affected investment sentiment right from the start of 2022 by arresting the head of FLC Group. He had been manipulating the stock market for several years through the five listed companies that were part of the FLC group. Institutional investors have avoided these companies, but retail investors willing to take risks have liked to gamble with them. The authorities blew the whistle in February 2022.

The Vietnamese government then started to go through the high bid prices for the land plots in Thu Thiem auctioned in downtown Saigon, which were financed with corporate bonds. Bonds were sold also to retail investors on attractive terms, contrary to the SBV’s guidelines. The Vietnamese administration has systematically tried to clean up the marketing practices of bonds in the real estate sector, and in September a new regulation on marketing came into force, which clarified the situation. However, the issuers of the bonds that were previously launched and marketed against the guidelines are still being questioned.

In October, the chairman of the board of the high-profile VTP real estate company was arrested, and it is obvious that the company will be forced to pay back the financing it received through bonds. VTP Group’s bonds had been sold through SCB Bank, which has close connections with VTP. The news of the arrest caused a serious bank run from SCB Bank. The SBV quickly intervened and changed the top management of SCB Bank. TPB, one of the banks in our portfolio, mentioned that it had received about VND 5 trillion worth of additional deposits after SCB was caught in the middle of the scandal.

The VTP group’s assets are significant, and it will certainly take care of its liabilities, but now the entire Vietnamese stock market has panicked, as the disciplinary actions of the corporate bond market have quickly frozen refinancing for several companies. There are a lot of rumors circulating, and investors have feared that Novaland, a listed company, which has had the highest debt-to-equity ratio (1.4), and an unlisted company, Hung Thinh Land, (D/E 1.3) could go insolvent due to a liquidity crisis, even if the companies’ debt burden does not look overwhelming.

Is it possible that companies will go belly-up?

Both Novaland and Hung Thinh Land are profitable companies, but we cannot rule out the possibility that they would run into difficulties caused by illiquidity crisis. It is also possible that some other company that has invested heavily in growth with the support of the corporate bond market would run into problems too.

What is the situation with housing developer Vinhomes

Vinhomes is practically net debt free. To improve liquidity, Novaland and Hung Thinh Land have started to sell apartments from their projects in the Saigon area with special payment terms. This will weaken Vinhomes’ apartment sales in the Saigon area for the next 6-9 months. Market disturbances and interest rate hikes will delay the launches of Vinhomes’ new big projects. Vinhomes remains profitable but will have to wait for the situation to improve.

Is it possible that the banking sector crashes?

SCB bank was created after the Vietnam banking crisis of 2009-2012 by merging three troubled banks. Now SCB is under the guidance of the State Bank of Vietnam. It is possible that also some other rather insignificant banks may find themselves in acute illiquidity if confidence in the market would not return in the next few months.

There has not been an oversupply of housing in Vietnam, on the contrary, the conditions of the Covid-19 era and the slowed-down processes of building permits have kept housing output low. We are not aware that the large banks would have recklessly financed the real estate sector, and to our knowledge, the loans have received appropriate collateral. Most of the lending is aimed at end-user mortgages with long repayment periods. Bank stocks have been oversold compared to their positive outlook.

The Fed’s frequent and sizeable interest rate hikes have caused Asian currencies to weaken. The Vietnamese dong had been relatively stable for a long period of time. It has fared better than Asian peer currencies, supported by Vietnam’s stronger export growth, and the dong has not been freely convertible. In the past years, the SBV has had to intervene and curb the appreciation pressure of dong, but in recent months the situation has reversed.

Vietnam has not been hit by currency flight externally, but companies operating in the country and wealthy individuals have converted large amounts of dongs for dollars in the face of uncertainty. During the summer and early autumn, the SBV did not want to raise the key interest rates to defend the dong, but it intervened in the foreign exchange market by selling dollars. Now the State Bank has started to hike the interest rates as well, although there has been no need for interest rate hikes in Vietnam caused by inflation. Interest rate hikes purely work as a tool to manage the exchange rates in the short term. In recent months, the Vietnamese dong has weakened quite strongly against the dollar, and since the beginning of the year, the value of dong has weakened by 8%. The fall of dong has also had a full impact on the PYN Elite’s NAV.

When will the situation cool off?

The Vietnamese administration is absolutely doing the right thing in restoring discipline and order to the market, but the timing of the actions could not have been worse, as at the same time there is plenty of uncertainty in the international financial markets. The state of Vietnam’s economy and the health of company earnings growth would not have called for such confusion in the market, but political decision-makers wanted to act vigorously right now. I believe that the situation will calm down in the coming months, although strict guidance may well continue for the next few years on the public administration side.

Where is the bottom for the stock market sell-off?

When the stock market crashes in panic and because of rumors, it is difficult to use fundamental ratios for defining a bottom level. Shares are very cheap at the moment, and I’d rather try to determine how high the Vietnam index can end up based on fair valuation multiples in the next few years. The reasonable index levels are clearly higher than where the market entered this year.

What should a PYN Elite customer consider now?

- I have not found any macroeconomist’s report predicting weak economic outlook for Vietnam for this decade.

- The situation caused now is shocking. It must be taken seriously, but also as analytically as possible, distinguishing Vietnam’s strengths and weaknesses in order to gain an insight into what might happen in the next 12 months.

- In terms of the emerging economies of Southeast Asia, the key turning point could be when the Fed starts to indicate that the biggest interest rate hikes are behind. This would create a counter-movement to the over-valued dollar, whereby the Asian currencies would strengthen and remove the pressure from countries to raise interest rates. This can take place even without the Fed starting to ease interest rates, as the disappearance of the expectations of further rate hikes could trigger a reversal with the dollar.

- The Vietnamese stock market could find its bottom even this week or in the next few weeks, if and when the interest rates could peak in Vietnam at the beginning of the year, January–February 2023 and the stock market would anticipate that moment three or four months ahead.

- The NAV on PYN Elite must increase by 64% from its current level before the fund manager is entitled to a performance fee next time, meanwhile, the customer gets a “free ride” when making additional subscriptions to the fund.

Should we worry about Vietnam’s earnings growth?

Let’s look at the bank TPB in PYN Elite’s portfolio. Its weight in the portfolio is 9%. I thought the stock’s P/E 6 was ridiculously cheap. But even so, this stock has now plummeted and is trading at a P/E of 4. The company’s ROE is over 20% and the earnings will grow by 35% this year.

I met the CEO of TPB in Hanoi on Friday, and he seemed very relaxed: the NPLs are not shooting up, and the interest rate hikes are not a concern to him. At this year’s AGM, the bank confirmed its goal of 35% earnings growth for 2022, and the bank is still guiding to achieve this. Vietnam’s economic growth will certainly slow down in the first half of 2023 due to increased interest rates and weaker export demand, but even these factors do not give a reason to doubt the earnings growth outlook of Vietnamese domestic companies in the coming years.

Here are a couple of other examples of our top holdings and their valuation levels: housing company VHM and MBB bank.

Housing company VHM has fallen to historically low valuation levels. Similarly, the valuation multiples of the strongly growing MBB bank have dropped to very low levels. Attached is more detailed information about these companies with a few selected valuation multiples. They describe the situation of PYN Elite portfolio: there are quality companies that trade at attractive valuations, but the stock market’s short-term outlook is unpredictable.

Important information regarding the text and the Fund

The attached publication is marketing material and should not be regarded as a recommendation to subscribe or redeem units of the PYN Elite Fund. Before subscribing please familiarize yourself with the Key Investor Information Document, the Prospectus and the Rules of the Fund. The material presented in this text is based on PYN Fund Management’s view of markets and investment opportunities. PYN Elite Fund (non-UCITS) invests its assets in a highly allocated manner in frontier markets and in a small number of companies. This investment approach involves a larger risk of volatility compared to ordinary broadly diversified equity investments. The value of an investment may decline substantially in unfavorable market conditions or due to an individual unsuccessful investment. It is entirely possible that the estimates of economic development or a company’s business performance presented in this presentation will not be realized as presented and they involve material uncertainties.