The biggest weighting in our portfolio, the Vietnamese retail group MWG, at 16.7%, just released its January-April results for 2019: Net profit grew +36%, to VND 1,424 billion (1,044), and the strongest growth in revenue was seen in online sales +69% and groceries +165%. Our net profit growth target for the whole of 2019 is +27%, which would result in a total profit of VND 3,658 billion (2,878). The early-year result indicates even stronger net profit growth.

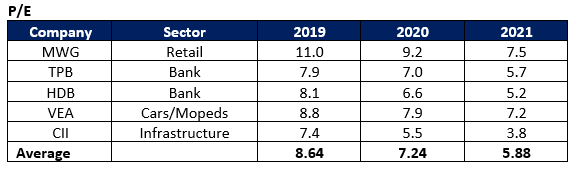

The table shows PYN Elite’s five largest positions and their P/E ratios for three years. The five largest make up 48% of the entire portfolio:

I spent my Friday in Hanoi visiting three schools. A Vietnamese education business is planning an IPO and we are considering participation. After my school day was over, I took a seat in the lobby bar of the Metropole hotel (the same bar where Kim and Trump sat just 3 months earlier) together with SSI’s investment banker to discuss their active cases. We touched on several companies in our discussion and finally she mentioned Vietnamese banks, puzzling at their dirt-cheap level considering that their earnings development is guaranteed for the next few years. I agreed with her and, as fate would have it, the entire team of the Bangkok based fund manager NT Asset walked into the bar at that very moment. They had just finished visits to six banks, of which they currently don’t hold, but one can assume, that the team’s bank analyst was trying to win portfolio managers over into investing in banks.