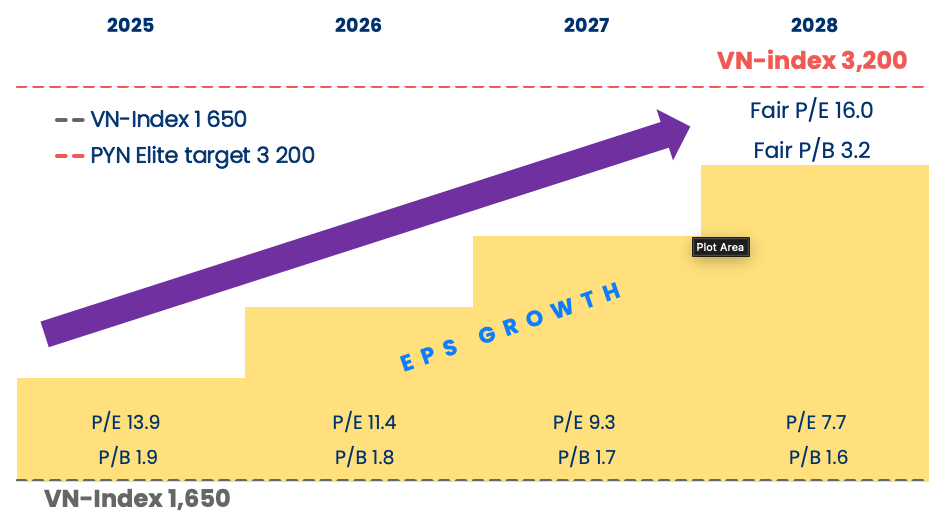

When we picked Vietnam PYN Elite’s target allocation about ten years ago, we set a long-term index target to 2,500 points for the Vietnamese market. We have now come to the conclusion of raising that VN-Index target to 3,200 points. At present, the VN-Index trades at around 1,650 points.

The key considerations for this decision: Vietnam’s new administration is steering the country decisively toward a higher level of prosperity, and the public Mega projects will drive this new strong growth era and accelerate private-sector investments as well. Simultaneously, the modernization of Vietnam’s financial markets is advancing rapidly, and banks’ loan growth is being actively supported. In summa summarum, these policies create even more favorable conditions for Vietnam’s economic expansion and for companies’ robust earnings growth.

Graph: The VN-Index’s P/B valuation has exceeded the 3.0 level three times over the past 15 years. Over the long term, the average P/E ratio has been around 16, and in three periods the P/E has risen above 20. Our new index target of 3,200 is based on an expected average earnings growth rate of 18–20% over the coming years. In 2025, earnings growth is likely to exceed 20 percent.

PYN Elite’s performance has unfortunately moderated over the past six weeks and stands at only about +15% YTD. Investors have continued profit taking, particularly in stocks that have had strong outperformance. Despite this, consensus indicates that the outlook for 6- and 12-month returns remains very positive. The market may resume its bullish trend at any time.