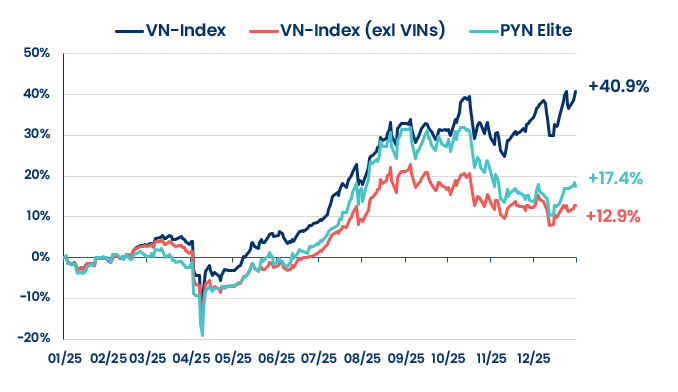

VN Index recorded an exceptional year, rising by +40.9%. The flagship stock of the VIN Group, VIC, delivered a remarkable gain of 736% over the year. VIC carries a 16% weighting in the VN Index, while the combined weighting of VIN Group-related stocks exceeds 20%. By year-end, VIC’s market cap reached EUR 42 billion, making it the most valuable company on the Vietnamese stock exchange.

VIC’s explosive rally played a central role in the VN Index’s outstanding annual performance. Excluding the four VIN Group stocks, the index’s annual return would have been +12.9%.

PYN Elite delivered a return of 17.4% in 2025. The strengthening of the euro would have eroded the returns of PYN Elite’s holdings over the year, but this was effectively managed through EUR/USD currency hedging. During the first nine months of the year, PYN Elite achieved an excellent 30% return through well-selected positions, without exposure to VIN-related holdings. Unfortunately, over the final three months of the year, Vietnamese equities declined broadly, including nearly all banking and financial sector stocks. At the same time, the VIC share price continued its outperformance. This three-month period weighed heavily on PYN Elite’s full-year returns.

Such performance gap between the index and the fund naturally raise the question of why VIC was not included in PYN Elite’s portfolio. Below are some of the key arguments that explain how an investor with PYN Elite’s investment style views the VIC stock.

The company is opportunistic and is currently benefiting from the momentum driven by major projects backed by Vietnam’s political leadership. However, its future cash flows are almost unpredictable by financial models. In recent years, the company has become increasingly leveraged, and one of its two main pillars, the EV business, has absorbed virtually all the profits generated by the group’s housing business. Holding company’s liabilities relative to equity have increased significantly and now exceed 500%. In addition, the receivables and liabilities among the group’s sister and subsidiary companies form a highly complex structure. The extraordinary surge in VIC’s share price over the year leaves us astonished by what has unfolded.

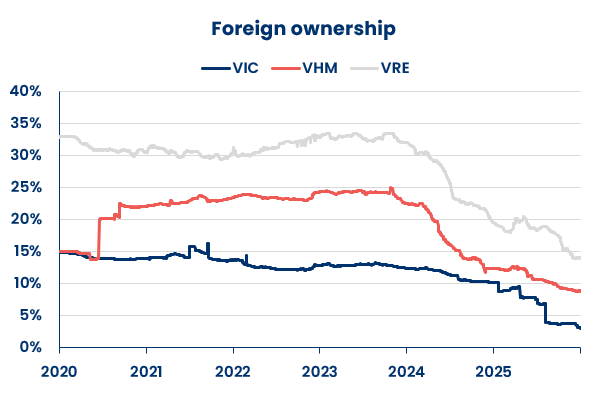

Professional foreign investors have been reducing their exposure to VIN Group shares for several years. For example, foreign ownership in the group’s flagship stock, VIC, declined during 2025 from around 10% to just 3%.

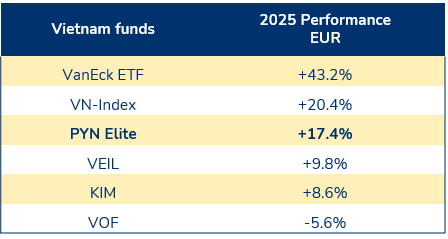

The largest actively managed Vietnam funds were without exception underweight in VIC during 2025 or did not hold the stock at all. As a result, all these funds posted returns for 2025 that were clearly below the benchmark index.

Here are the funds’ returns in euros. ETF funds delivered strong performance and even outperformed the index, as VIN Group stocks at times rallied so rapidly that their weights within the ETFs exceeded their respective weights in the index.