For three years, 2022–2024, the VN-Index moved sluggishly and recorded a decline of -15.4%. Now things are different. The stock market is gaining good momentum, and the pace may even accelerate further.

Based on the current fundamentals, this could turn into a so-called Big Year for the equity market performance. In such a case, the essential factors align, and the outcome is reflected in the market. During PYN Elite’s history, we have experienced four Big Years – 1999, 2003, 2009, and 2012 – when the fund’s annual returns rose between 64% and 199%.

Why a Big Year is possible now:

- Government spending is boosting economic growth.

- Vietnam’s liquidity is ample, and the government is supporting bank lending.

- The uncertainty over Vietnam’s exports to the U.S. caused by tariffs has been resolved.

- Index provider FTSE is set to upgrade Vietnam’s market classification to EM status in October.

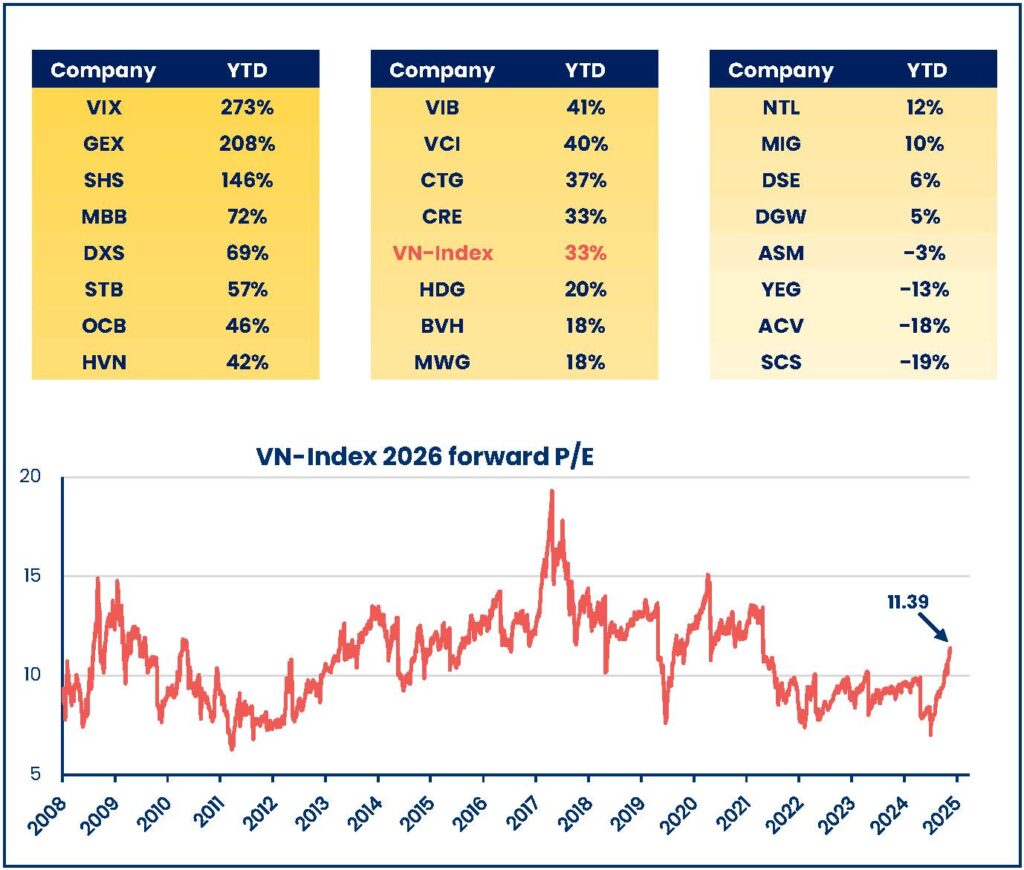

- Earnings growth outlook is strong: 2025 +32%, 2026 +19%.

- With such earnings growth, the 2026 P/E level is 11.1.

- The market rally has been highly concentrated, and rotation will fire up new stocks and sectors in motion.

In PYN Elite’s portfolio, we aim to maximize returns from our hot positions. We are also able to rotate positions, as the portfolio’s stocks have performed very unevenly this year. A strong rally naturally comes with high volatility, swings, and potential corrections.